Table of contents [Show]

Trump 2.0 Fears: A Global Ripple Effect

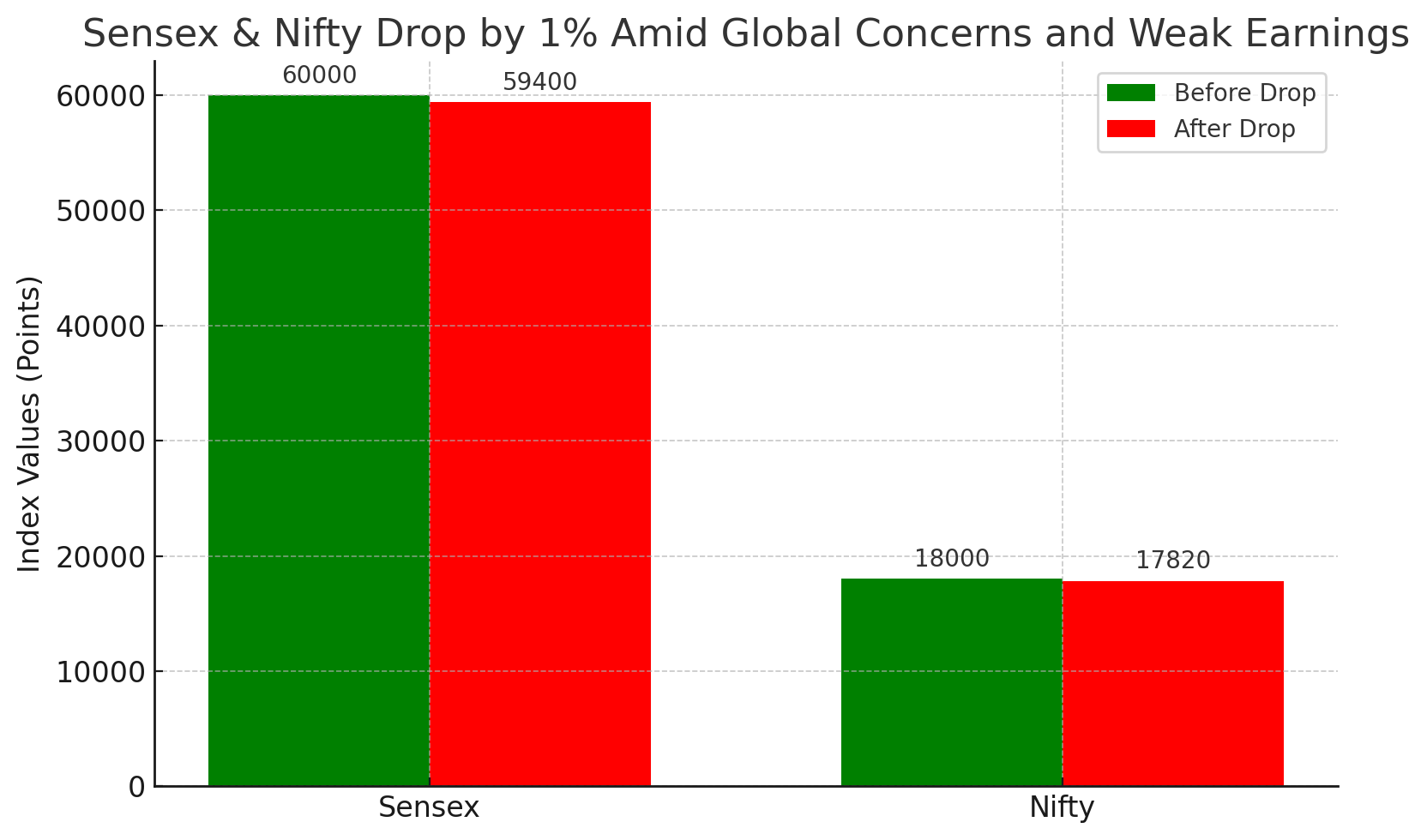

The global market sentiment has been under pressure due to growing uncertainty around the potential return of former U.S. President Donald Trump's trade policies, often referred to as "Trump 2.0." His approach to tariffs, trade wars, and a more protectionist stance has sparked jitters in international markets. India, with its significant export base and global trade connections, could face the brunt of these policies, especially in sectors like IT, pharmaceuticals, and automotive. The possibility of escalated trade restrictions or new tariffs on Indian goods has created an air of apprehension, leading investors to take a cautious approach.

The repercussions of such trade tensions have been felt across Asian markets, with India following suit as foreign institutional investors (FIIs) pulled back their investments, citing the increased uncertainty surrounding global trade.

Weak Q3 Results: Domestic Struggles

Domestically, the quarterly earnings results have been another key factor contributing to the market's underperformance. The Q3 earnings season revealed disappointing results from several major companies, particularly in the consumer goods, banking, and automotive sectors.

The weaker-than-expected profits, coupled with rising raw material costs, labor shortages, and global supply chain disruptions, have hurt many companies' bottom lines. Investors had anticipated a strong showing in Q3 following a period of economic recovery, but the results have been underwhelming, further fueling bearish sentiment.

Banks, which had shown resilience in earlier quarters, reported lower-than-expected loan growth, while automobile manufacturers struggled with inventory shortages and higher input costs. This has raised concerns about a potential slowdown in India's recovery momentum, prompting a cautious outlook for the remainder of the fiscal year.

Sectoral Impact: IT and Auto Hit Hard

While the broader market faced a decline, certain sectors were hit harder than others. The IT sector, which had been a consistent performer, saw a dip due to global macroeconomic concerns. Investors are wary of a potential slowdown in global demand for IT services, especially in the wake of global economic uncertainties.

The automobile sector, too, faced challenges, as supply chain disruptions and rising commodity prices added pressure on profit margins. Despite a long-term growth trajectory, short-term challenges have led to investor caution, with several auto stocks trading lower today.

Looking Ahead: Caution Amid Uncertainty

The market's performance today underscores the growing concerns over both global and domestic factors. While there is optimism surrounding India's long-term growth story, the immediate outlook remains clouded by Trump 2.0 uncertainties and disappointing corporate earnings.

For investors, the current market environment calls for caution and a focus on sectors that are more resilient to external shocks. Additionally, monitoring Q4 earnings closely will provide a clearer picture of how companies are adapting to the evolving global landscape.